The big bad wolf may at last be leaving. One thing is for certain, it is no longer baying at the doors of carmakers and designers. Two years of recession in the automotive industry have been a tough ordeal for Italy’s heartland of design, centred in and around Turin. As always, however, there have been those who have shown inventiveness and the courage to explore new roads in search of the essential to overcome the worst moments and lead the way to recovery. An in depth survey by Auto&Design of designers, modellers and prototype fabricators, encompassing small and large companies alike, from world renowned names to the less well known, reveals a scenario shot through by a few glimmers of optimism, and pervaded by a serenity and hope which, while still hazy, would have been unthinkable just a few months ago.

However, a recent survey by CERIS-CNR for the Piedmont region entitled “The style sector and industrial policies for the automotive industry in Italy and Europe” paints a still worrying picture. The survey indicates that all the design studios in the region (the vast majority of which operating in the automotive segment), which provide work for 50 thousand employees and generate an outstanding per-capita turnover of 240 thousand Euros (for a total of 12 billion Euros), are still experiencing difficulties. To be precise, two out of three of these companies are still keeping all or a part of their workforce temporarily laid off (only one has had to retrench, while another has actually taken on more personnel).

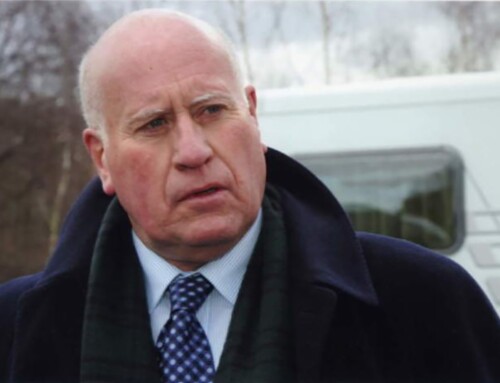

Leonardo Fioravanti, president of the ANFIA Italian car manufacturers’ association, noted that, according to the survey, 40% of companies foresee a 20-30% loss in turnover for 2009, another 40% are reporting a reduction of 50-60% and 7% are expecting a drop in turnover as high as 70%. Fioravanti’s own company belongs to the first of these groups, with a balance sheet in the red (“but it’s a limited deficit, at least” due in part to the importance of patents developed in previous years) and 30% of its workforce temporarily laid off for three months. However, he also expects to see a possible recovery in 2010, and in the second quarter in particular, with new contracts both in Italy and abroad. “We foresee two possible scenarios”, he adds, “one of evolution, where we should be approaching turnover figures similar to 2007, and one of innovation, with ambitious strategic goals: this would be a great challenge which, however, may well be worth facing”. His greatest hope is that this recession will “sweep away all the uselessness, exaggeration and idiocy seen in recent years, dictated by marketing and advertising”, and that design “rediscovers its true values”, and he believes that Italian designers are the best equipped to succeed in both of these aspects. “Beauty will save us”, he repeatedly notes, in a reference to Plato, for whom beauty was “the splendour of truth”.

Other companies that have been forced to temporarily lay off their personnel include Pininfarina (20% of the engineering division for 4-5 months, although the design division was spared), Stile Bertone (50% of the workforce for two months and a residual 10% afterwards) and Torino Design (50% of the workforce for two and a half months). Italdesign and Giugiaro, however, managed to avoid this drastic measure. For modellers and prototype fabricators the scenario is similar if not even worse, with their troubles compounded by the major carmakers cutting back on concept and show cars. G Studio admits that it is working “at a reduced rate” (in other words with a smaller workforce), Polimodel confirms that it temporarily laid off 20% of its personnel from September to October, while Cecomp notes that it had to temporarily lay off the staff of its style division (models and prototypes) for four months, and that it was saved only by its mould manufacturing operations for niche products. “Our job is to keep on working” is Cecomp CEO Giovanni Forneris’ reply to those who ask him why he is constructing new factory buildings in these troubled times.

Yet the buds of optimism are beginning to blossom. Lilli Bertone, back at the helm of Stile Bertone after selling the Carrozzeria wing of the company, says that “while it is still too early for a full scale recovery, things are beginning to change”. Sharing her opinion are Roberto Piatti of Torino Design (with the caveat “as long as there are no new problems in 2010”), Italdesign managing director Enzo Pacella (“the freefall has stopped, we are stable now and must start growing – we should be seeing a good improvement in the second half of 2010”), Tesco commercial director Mauro Garcin (“I am cautiously optimistic: we are on the way to recovery, but there will be very little to show before March”), Giovanni Forneris of Cecomp (“modelling is back in full swing, our order book is full up until spring”), Pininfarina director Silvio Angori (“style is at full capacity, engineering isn’t, but does have 18 months’ worth of orders”).

Hope aside, what is actually happening? The figures for 2009 speak for themselves, testifying that almost everyone is struggling. Stile Bertone managing director Marco Filippa speaks of a drop in profits of 25-30% compared with 2007 (but foresees a 20% growth in 2010), Italdesign reports 10-12% less profits over 2008 while Pininfarina claims to have held steady in 2009 (although 2008 was a bad year). The situation is decidedly worse for the modellers: one particularly representative case is Cecomp, which reports a drop of 40-50% in profits for the first six months, followed by a return to “normal levels”. In addition to a reduction in new orders, almost all – with Stile Bertone being the only exception – speak of existing contracts being put on the back burner or temporarily on hold, while in some rare cases, contracts have even been cancelled. All, and the smaller companies in particular, are complaining of late payments. “You can only get paid when there’s money”, notes Pietro Guerrieri of Polimodel pragmatically. Piatti of Torino Design is more scathing: “the crisis seems to have been taken as a licence for unscrupulous behaviour”.

The companies in the area have been receiving fewer orders from the Fiat Group, which is bringing as much of the process as possible in-house (although Pininfarina and Tesco speak of “constant levels”, while Stile Bertone nurtures the hope of more work generated by the renaissance of the Chrysler brand). “Turin abandoned us in troubled waters”, says Forneris of Cecomp. But Fiat is not alone, and fewer orders have also been forthcoming from the Germans and French. Many have striven to weather the storm by exploring new avenues, which essentially means Asia or radical diversification. Practically everyone, and modellers and prototype fabricators in particular, have taken the road to China (and, to some degree, India). Pininfarina speaks of a fifty-fifty balance between Europe and Asia, for Stile Bertone, the East accounts for 40% of its turnover (“in our forecasts for 2011-12 – says Filippa – the European percentage will be larger”), a controversial Piatti of Torino Design says that “without China and India, Turin would have been dead five years ago”, while Garcin notes that Tesco has also worked for Gheddafi’s Libya. There are very few who, like Pierangelo Maffiodo of G Studio, say no to the allure of the Orient.

Some – although it is not clear who, as accusations are flying in all directions – are cutting prices. “A fundamental strategic mistake, it’s business suicide”, says Pacella of Italdesign. “Some are working practically for free – adds Piatti of Torino Design – just to secure an order. Many are offering prices lower than 25 years ago for the same services”. For the majority, the only solution left for surviving the crisis was diversification. Stile Bertone, reveals Filippa, “has already acquired a major rail project, which will keep us very busy and has been assigned to the architect Franco Carretto. But we are also working in energy, the environment and pure research”. Tesco has also turned to the rail sector (Finmeccanica), as well as earth moving machinery (Same and Case-New Holland) and industrial design (Indesit and Merloni). G Studio has also ventured into industrial design, developing boats and household objects (but has also designed trucks and motorcycles). Torino Design has sealed an alliance with the British company MIRA, with which it is currently creating a whole new family of Ashok-Leyland commercial vehicles for India.

Everyone does what they can – the most important thing is that the wolf really has gone from the door.

The article continues in Auto & Design no. 180